Bloomberg Multimedia is out this morning making the case for deflation. They note that the primary drivers that have kept inflation low in the past year are still quite strong: a very weak job market, weak spending, and depressed consumer confidence. In fact, just this morning the Conference Board reported consumer confidence falling sharply from last month. The survey showed consumers extremely bearish in their expecations for future income, which really should be turning your deflation lightbulbs on.

Bloomberg also mentiond the popular “fears” behind inflation forecasts, a ballooning FED balance sheet and rising commodity prices, may be overblown.

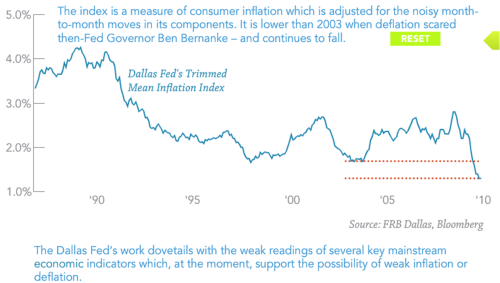

Exibit 1: Trimmed Mean Inflation Index

Source: Bloomberg

Using a trimmed mean index, the inflation rate is calculated as a weighted average of componenets after the “highest” and “lowest” values have been taken out. This takes out any extreme outliers. The trimmed mean index has been shown to out reflect inflation more accurately than the tradional CPI-ex food and energy measure.

The chief deflationary force last year was the job market, as layoffs and lack of pricing power from employees has depressed salaries and spending. American worrying about future income are still trying to repair their household balance sheets and recover lost net worth. Household net worth is still well below 2007 levels.

Source: Bloomberg

Additionally, in the face of battered household balance sheets and an uncertain and gloomy job market, consumer confidence remains depressed and consumers are finding a new found frugality. Many wonder if there will be a structural shift in consumer spending.

“I do think there’s been some structural change out there, not unlike what happened after the Great Depression where for a generation or two, there was a change in the way people thought about value. Customers making more than $40,000 a year continue to grow as a percentage of our new sales.”

Family Dollar CEO Harold Levine

Source: Bloomberg

Interestingly, Bloomberg takes a look at the monetary warning signs of inflation. It is commonly thought that excess reserves will translate into a greater money supply which will then lead to higher inflations. Many inflationistas have been berating the government for “printing money” yet a look at the M2 money supply index shows a different story.

Source: Bloomberg

However, it is true that banks have kept an unprecented amount of free reserves at the Fed, some $988 billion. However, for these funds to cause inflation, banks would need to lend it out. As we have seen, bank credit and bank lending has not picked up.

source: Gluskin Sheff

source: The Economist

Those putting on the “trade of a lifetime” by shorting Treasuries, expecting runaway inflation may want to reconsider the pull of deflation. Much of the improvement in economic statistics are due to an unprecidented push by the World’s governments and in no small measure the US Treasury and Federal Reserve to fill the demand gap left by the private sector in the throws of the worst recession in decades. Much of this stimulus will expire or start to wind down of the course of 2010. There are enough headwinds for the economy that a double dip recession or such slow growth that it may feel like a recession are not 0% probability events. Runaway inflation could still come down the road, but 2010 is not the year to begin seeing it. The “trade of the century”, ie shorting long term Treasuries, may be a terrible trade over the course of the next 12 months.

0 Responses to “Bloomberg: Deflation Risk Persists”